Author |Spike Editor |Jerry Crypto Copyright | ThePrimedia

The deep meaning of DeSOC is decentralized society, and Finance in DeSoc refers to finance in a decentralized society. It is the infrastructure of a decentralized society and has the property of universality, everyone is a node and a user. DeFi is the basis for future "financial in DeSoc" at this time.

The bad news is that DeFi appears to be deeply involved in a quagmire due to the serial liquidations caused by high leverage, the false prosperity generated by circular lending, the deviation of the governance model "DAO", the operation of user funds in the dark box, and the abuse of the token mechanism, which is slowly approaching its darkest hour.

Nevertheless, Defi may be viewed as an outpost of "financial in DeSoc," with a pioneering attitude, exploring the subject of Web 3 finances to help decentralized finance extend its wings.

The present issue for Defi is that "the centralized world has altered Defi, which aims to revolutionize traditional finance." The underlying layer is not decentralized simultaneously, but "the front-end portal is decentralized, but the back-end is still managed by centralized institutions." On the surface, it appears to be a competition between DEX and CEX exchange platforms. However, the market maker may be the same centralized organization, thus there is no assurance that user funds will not be stolen regardless of which valve they flow through.

The finance in DeSoc will be completely decentralized. The funds on the chain will be transparent and the governance process will be open. For the first time, we will abandon all centralized gluttony and build a decentralized mainstream financial market that belongs to the future, to Generation Z, and to eternity. DeFi under DeSoc will be the fresh sprout that breaks ground and paves the way for the next wave of crypto innovation.

The whole research report consists of three chapters.

Part 2:The death of DeFi, how institutions can hurt each other under the "Black Swan"

The end of institutional mutual benefit is institutional mutual harm. The "decentralized platform" is controlled by "centralized instituions", which is the reason why DeFi is currently in a quagmire, with the sword of Damocles hanging over the DeFi frenzy.

When DeFi reaches its peak in 2020-2022, the crypto bull market will come to an end. There have been a series of black swan occurrences in DeFi, and the farce is still sweeping in on a gigantic level. From Compound's liquidity mining to Luna-crash UST's in May 2022, the market has been riddled with farce, not to mention a string of pending explosions that are still extending and involve exchanges, market makers, lenders, hedge funds, and almost the entire DeFi base pieces such as 3AC, BlockFi, Celsius, Genesis, Nexo, Babel Finance, Maple Finance, CoinFLEX... It's as if an invisible hand is guiding the market in the right direction, causing the crypto-believers' nervous system to go into overdrive.

The Black Swan's origins remain a mystery. Some argue that DeFi's structure was already as problematic as it could be, while others argue that enormous leverage is to blame for the crypto currency market's demise. As long as there are downsides, the institutions will be able to take advantage of them at any time, and another fishy war may be staged with central institutions whaling on the earnings at any given time. Indeed, "DeFi, which intended to transform traditional finance by the centralized globe, has been changed."

When it comes to DeFi, the underlying layer hasn't been decentralized. At the same time, the front-end portal is decentralized, but the back-end is still a centralized organization, which makes it more strange. In what appears to be a competition between DEX and CEX exchange platforms, but the market maker may be the same centralized institution, there is no assurance that user funds will not be plundered regardless of which valve they flow through.

Because of DeFi's intrinsic flaws pervent it from effectively rejecting or controlling risks, centralized institutions were able to take advantage of the opaque high leverage and dry up DeFi. High leverage led to several liquidations, as well as false prosperity caused by cyclical loans. The diversion of governance model "DAO," user money being operated in secret, and token mechanism misuse all contributed to this. These are all appearances. When the butterfly flaps its wings, a whirlwind forms around it.

DeFi is being engulfed by the "institutional victimization" tornado. De-anchoring USTs on Curve is an example of DeFi's failures. Because of the illiquidity that will come from the withdrawal of UST money and the 20 percent Annualized Interest Rate of Anchor cannot be sustained, asking Curve to step in would be against the spirit of decentralization.to thirst-quenching the centralization spirit.

There are even runs and stampedes. Many people's expectations were exceeded when successive reports of mines caused a run and stampede in the market due to regular "black swan" events. To a certain extent, projects and institutions like Curve, Celsius, and Three Arrow Capital (3AC) were involved in this process.

Panic is sparked by high rates of collateralization. Despite having collateralization standards, loan programs like Aave may have customers whose collateralization rates are significantly lower than the needed value. stETH holders can mortgage new ETH on Aave, and exchange ETH to stETH through other DeFi projects, and then borrow again. Users can gain a lot of money in a rising market, but they run the danger of losing everything in a falling one if they employ this cyclical process.

It's impossible to stop a negative feedback loop once it's started. Whenever the price falls sharply, Aave's highly leveraged users may be forced to sell their stETH holdings, which will lead to an even greater drop in the value of the coins, creating a vicious cycle of price declines and further serial liquidation that will eventually send the price of stETH plunging.

Three Arrows capital will inevitably go bankrupt. Luna-UST flash crash led to a cascade of deficits among 3AC's borrowers, such as Celsius, found that their funds could not be recovered smoothly, resulting in a series of institutional margin shortages, which led to insolvency bankruptcy crises like BlockFi. Fundamentally, the average user had no idea how or when 3AC had obtained money before the incident, and we only learned about Nexo's denial of lending to 3AC after the fact. It won't help at this stage.

Instituional mutual harm is the fundamental sin of Defi. It was DeFi that had its problems, and they were staged by centralized institutions, which followed market guidelines and did not have laws that prevented CeFi from splitting with DeFi. So if they did not take advantage of this bear market to solve them once and for all, there would be another crisis.

Institutional mutual harm is a continuation of historical theory. When it comes to CeFi, it's all about information differentials. If the information can be obtained by each market entity, the market liquidity cannot be established. And DeFi is a decentralized core element that's as commonplace as air, water, and networks.

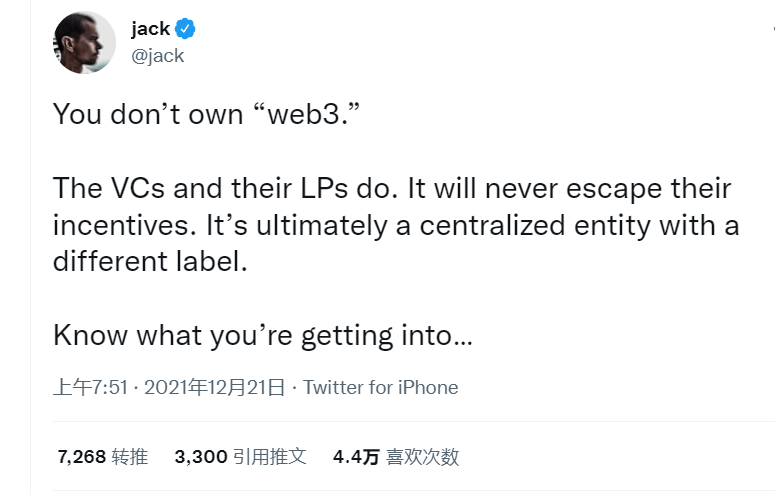

It has been reported that Twitter founder and CEO of Block Jack Dorsey has tweeted some anti-crypto and anti-"Web 3" thoughts, which have angered some of their biggest proponents. If you're thinking about Web 3 as "right-click thinking," Dorsey gets right to the point. Venture capitalists like Anderson Horowitz will govern these new web systems, not users.

Source : jack twitter

The "governance token" is a weapon of mass destruction for institutions. Since the inception of Bitcoin, the Token concept has been in use. It's all about developing a set of internal rules for token distribution and flow to ensure the project's long-term viability and sustainability. Ethereum has made it possible to write precise rules of the game in smart contracts, which means token incentives flow to as many users as possible who offer high value to the business's core and nodes.

Regardless of the stage of a project's development, a token economy model, if properly designed, should be able to maintain a stable supply and demand relationship and usage scenario regardless of the stage of the project. That is, led by smart contracts, rewarding tokens to those users or communities that can successfully build the ecosystem, maximizing the "use efficient ways to capture the value of the agreement," and entering into a positive feedback loop.

Being a "governance token" is not the same as having a Token. Having Tokens on the blockchain is essential, and without Tokens, the blockchain is a joke. However, Tokens should never be referred to as "governance tokens." We can see that "governance tokens" were primarily established by Uniswap as a desperate response to Sushiswap's vampire attacks when we look at the history of governance tokens. Its whole idea has never been clarified, and its influence has been with us today and has become a stumbling block to its development.

"Institutional victimization" has been sparked by "governance token." Take the two giants in the crypto area Uniswap and SushiSwap as an example, SushiSwap needs 5 million or 5.5 percent of the 90 million eligible SUSHI votes to pass the proposal; UNI needs 40 million votes (or 12.5%) to pass the proposal. The unequal distribution of voting power is a result of the project's initial inequitable structure. An enormous and long-lasting impact was made by the first 40 percent distribution of Uniswap, with 46 percent of the votes still held by the top ten voters (mainly investors or advisers) today. Sushi looks to be more evenly distributed, yet the top 10 wallets control up to 29% of the votes. Naturally, Uniswap's decision to use USDC airdrops instead of the company's own Uni after acquiring Genie seemed like a means to correct the wrong, but it also overextended trust and expectations.

Abuse of "governance token" is to blame for institution mutual harm. We conclude that token economics must serve the value opportunity based on project development, rather than market cap management, as a result of this evidence. This should be a rule of thumb for the industry. DeFi's spring will arrive after institutions stop abusing Tokens as a tool for evil.

Please look forward to the following analysis.

Part 3: Finance in DeSoc, a valuable opportunity for all for the benefit of all