Author |Spike Editor |Jerry Crypto Copyright | ThePrimedia

The deep meaning of DeSOC is decentralized society, and Finance in DeSoc refers to finance in a decentralized society. It is the infrastructure of a decentralized society and has the property of universality, everyone is a node and a user. Meanwhile, DeFi is the basis for future "financial in DeSoc" at this time.

The bad news is that DeFi appears to be deeply involved in a quagmire due to the serial liquidations caused by high leverage, the false prosperity generated by circular lending, the deviation of the governance model "DAO", the operation of user funds in the dark box, and the abuse of the token mechanism, which is slowly approaching its darkest hour.

Nevertheless, Defi may be viewed as an outpost of "financial in DeSoc," with a pioneering attitude, exploring the subject of Web 3 finances to help decentralized finance extend its wings.

The present issue for Defi is that "the centralized world has altered Defi, which aims to revolutionize traditional finance." The underlying layer is not decentralized simultaneously, but "the front-end portal is decentralized, but the back-end is still managed by centralized institutions." On the surface, it appears to be a competition between DEX and CEX exchange platforms. However, the market maker may be the same centralized organization, thus there is no assurance that user funds will not be stolen regardless of which valve they flow through.

The finance in DeSoc will be completely decentralized. The funds on the chain will be transparent and the governance process will be open. For the first time, we will abandon all centralized gluttony and build a decentralized mainstream financial market that belongs to the future, to Generation Z, and to eternity. DeFi under DeSoc will be the fresh sprout that breaks ground and paves the way for the next wave of crypto innovation.

The whole research report consists of three chapters.

Part 1: Finance in DeSoc, A peer-to-peer personal mutual market system

There will be an initial push in DeSoc towards financial markets, which will take place in the form of a transition from institutional mutual benefit to personal mutual market.

Institutions cannot be the ones manipulating the technology. Liquidity for DeFi is provided by AMM, also known as "Market Maker Automated Robots," which is a aggregation mechanism based on formula for automatic trading. The different variants of this mechanism are used by today's prominent DEX, such as Uniswap and Curve. However, liquidity for DEXs is still provided by centralized institutions rather than decentralized nodes.

Humans should always be the ones in control of technology. To put it another way, the "personal mutual market" means that individuals become the flesh and bones of the AMM system. This is the correct way to open finance in DeSoc, and then extend it to all parts of DeFi. It is used out of demand, and everyone is a market maker for everyone else. The removal of institutional market makers from the DEX market completes the de-institutionalization process of DeFi.

The "personal mutual market" operates on the principle of "everyone for themselves." So that people can use DeSoc's financial services as easily as they use short videos in DeSoc, we need to aggregate DeFi to a higher-dimensional viewpoint and genuinely rely on the blockchain network to construct financial services.

To achieve "personal mutual market" free of institutional links and regulations, a DAO governance model is necessary. Direct democracy with no intermediaries makes it possible for everyone to take part in the financial system without any hindrances. A vote that can be made independently by the community, a decision that directly represents the DAO members' preferences, or community rules that can be accessed freely. It provides the soil and nutrients for personal mutual markets to thrive, supported by DAO smart contracts and technology tools.

DAO governance removes frictional costs. There is virtually no friction in financial services because DAO governance eliminates the need for bureaucratic red tape and administrators who charge exorbitant premiums or fees. As a result, individuals who use financial services can avoid paying brokerage fees, bridge fees, and other fees, which are the fuel that drives the development of personal mutual markets.

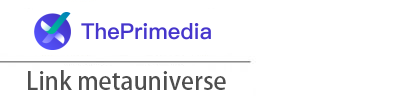

As a result of the DAO's stable token structure, members benefit from predictable revenue and an enjoyable DAO experience. After Ethereum is converted to a POS mechanism, the selling pressure of Ethereum will be sharply reduced, which will promote the deflationary mechanism of Ethereum and improve the stability of value transmission.

DeSoc's financial efficiency can only be improved if latency is kept to a minimum. As a result, the average block-out time will be reduced from 13 seconds to 12 seconds, and forks will no longer be necessary to ascertain the status of a block, but the security header block is used to. An expanding synergy between on-chain finance and traditional finance will be more effective, and DeFi will break the spell in terms of long wait times, unstable transmission, and security mechanism flaws.

For the time being, PoS will keep the number of DeFi customers stable. There are currently 83,662,470 Ether addresses, which is a new record high, and 42,329,272 BTC non-zero addresses, which is a new record high as well. It's like moving from a single pillar to two. Individual DeFi users will be created as a result of the increase in on-chain users, resulting in an on-chain financial marketplace free of agents and licenses.

Effective self-organization is necessary for user groups that are spread out. No management or subsystem is needed for self-organization. Instead, a disordered system can be brought into order and self-coordinated without the involvement of any intermediary or subsystem.

Individuals are freed from institutions as subjects of activity in financial life, whether it is topping up, transferring, lending, or mortgaging... are micro-actions that make up the economic network of individuals that effectively make up the huge ecosystem of financial activities.

Public chains are made up of nodes, and nodes are individuals. The operational efficiency of this self-organization can be significantly improved by the use of modular blockchains. All operations such as transaction processing, network consensus, and data availability are handled by a single system in current monolithic blockchains like BTC, ETH, and Solana, which is resilient but sacrifices operational efficiency. However, modular blockchains decompose the core components of the first-layer blockchain and improve specific sections, which can even increase advantages by a factor of 100 and make it easier for transaction data to be kept on a chain.

More scalable, modular, and decentralized technologies are required for DeFi. In a modular blockchain, the consensus layer and conduction layer can be decoupled. The consensus layer is only responsible for establishing data availability, transactions can be conducted off-chain in a modular blockchain. Because no on-chain transactions are required in this mode of operation, nodes can validate blocks more quickly and save space.

The ease of transactions must be taken into account in addition to efficiency while designing a "personal mutual market." With the rise of cross-chain, Ether's high gas prices are not only solved, but transactions are more efficient, and maintaining numerous assets becomes easier.

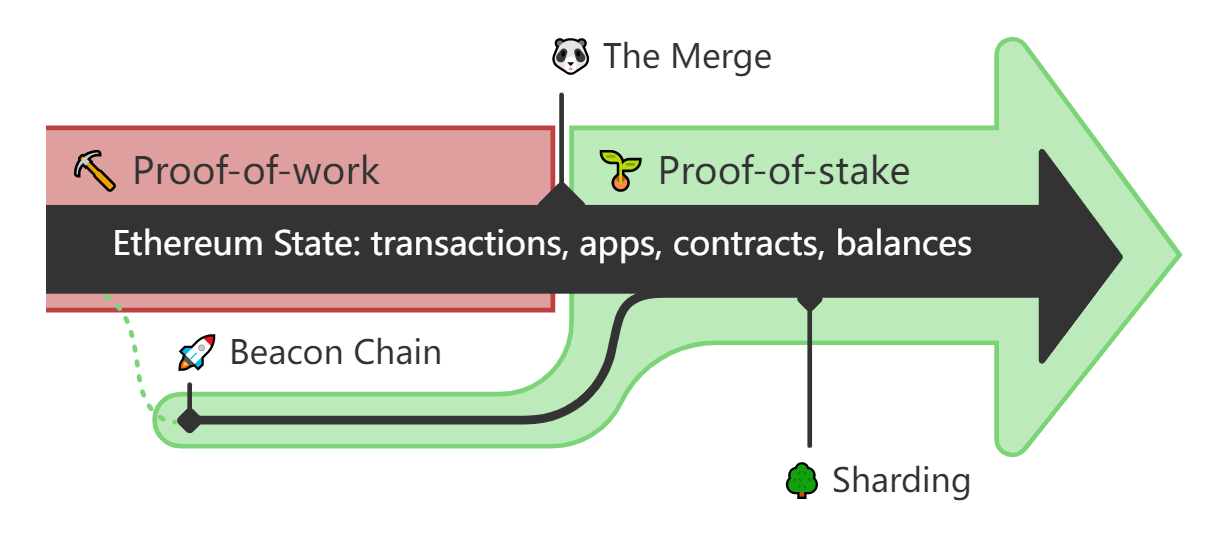

In many cases, the multi-chain coexistence option is more convenient. It is possible to eliminate the requirement for intermediary route conversion and accomplish one-click conversion when the major Layer 1 and Layer 2 communicate more smoothly. The ChainHop cross-chain DeFi project, for example, allows users to easily swap BNB from the BNB chain to USDC, removing the need for cumbersome procedures and intermediary processes and just typing in the quantity on the page to complete the conversion.

A major benefit of cross-chaining is the ease with which different types of assets can be combined. To save the effort and risk of losing valuable assets, users no longer need to store their assets on many platforms or wallets, which are time-consuming to administer and can be difficult to remember the storage locations and passwords for. In DeFi, an app of the asset management class has been born, allowing users of any blockchain to access approved DeFi rules with a single button click. Multiple types of assets, such as Lego bricks, can be stored in a user's asset package and transformed as needed.

This technique can be beneficial but should not be used excessively. Due to security concerns, its popularity is always affected, direct engagement with native assets is more innovative. In practice, cross-chains like WBTC and xDai use third-party bridges to match numerous public chain assets with each other to boost efficiency, but at their core, the two are not BTC and DAI, but mapping.

The full-chain model is closer to DeSoc's essence than the shadow model. Because the interaction on it is the fundamental exchange of assets between chains, there is no longer a need for cross-chain bridge transit. Full Chain Dex's product idea is identical to 1inch, except that 1inch aggregates the depth of other DEX, which is essentially "front-end of front-end, the entrance of entrance". DEX's Full Chain DEX concept goes a step further than that. The entire chain can be passed through after development is complete, allowing users to interact with assets on any chain in real-time.

A baby can become a "giant". DEX is an experiment at the moment, but it is projected to become a traffic hub for DeFi in the future, beating off the trillion-dollar transaction Uniswap. Chainge is one of the representives. Its entrance is directly through the moblie app, which integrates with 75 kinds of assests on13 public chains, allowing users to go about purchasing assets they would typically use a standard app in the same way, with no centralization. An actual public chain, rather than a centralized server, underpins its operation.

Source : https://www.chainge.finance

The DID, which we described in "In DeSoc: Value Discovery and Psychoanalysis of DID(Ⅰ)" as "the flow hub of all digital elements," is needed to help bridge the "front-to-back, top-to-bottom divide" across DeSoc. Rather than having to remember different usernames and passwords, users will be able to access multiple programs "in one line," which will allow them to move from a single ecosystem to a more integrated one. And the financial scene must be the shining one.

Please stay tuned for the subsequent discussion and analysis.

Part 2:The death of DeFi, how institutions can hurt each other under the "Black Swan"

Part 3: Finance in DeSoc, a valuable opportunity for all for the benefit of all